ny paid family leave tax rate

The maximum annual contribution is 38534. Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged.

Your premium contributions will be reported to you by your employer on Form W-2 in Box 14 as state disability insurance taxes withheld.

. NY Paid Family Leave. 0511 maximum of 38534 per year None. Paid Family Leave provides eligible employees job-protected paid time off to.

Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax March 15 2020 520 PM. Duration maximum 10 weeks. For 2021 the contribution.

On August 31 st New Yorks Department of Financial Services DFS published the NY Paid Family Leave PFL rate for the 2019 calendar year. On December 23 2020 the Office of the State Comptroller issued State Agencies Bulletin No. 2019 2020 Duration maximum 10 weeks Duration maximum 10 weeks Weekly Benefit 5 5 of AWW max AWW 74671 Weekly Benefit 60 of AWW max AWW 84070 7056972 annual wage cap 7286084 annual wage cap 135711 average weekly wage 140117 average weekly wage.

2020 Paid Family Leave Payroll Deduction Calculator. New York Paid Family Leave is insurance that may be funded by employees through payroll deductions. Weekly Benefit 60 of AWW max AWW 84070 Weekly Benefit 67 of AWW max AWW 97161 7286084 annual wage cap 7540884 annual wage cap 140117 average weekly wage 145017 average weekly.

The New York Department of Financial Services has released the community rate for New York Paid Family Leave effective January 1 2021. The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New York States current other factors. Would an employers experience rate increase in the next year if an employee uses the Paid Family Leave program.

NEW YORK PAID FAMILY LEAVE 2019 vs. Balance of costs over employee contributions necessary to provide benefits. Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW.

2018 2019 Duration maximum 8 weeks Duration maximum 10 weeks Weekly Benefit 50 of AWW max AWW 65296 Weekly Benefit 55 of AWW max AWW 74641 6790784 annual wage cap 7056972 annual wage cap 130592 average weekly wage 135711 average weekly wage Premium rate. The maximum employee contribution in 2018 shall be 0126 of an employees weekly wage up to the annualized New York State Average Weekly Wage. The maximum weekly benefit for 2022 is 106836.

Paid family medical leave. The weekly contribution rate for Paid Family Leave in 2020 is 0270 of the employees weekly wage capped at New Yorks current average annual wage of per employee per year. The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages each pay period up from 0270 for 2020.

New York Paid Family Leave is. In 2021 the contribution is 0511 of an employees gross wages each pay period. Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or.

Please visit the state Paid Family Leave website for a list of. In 2022 employees taking Paid Family Leave will receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage of 159457. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

There are various factors that can impact an experience rate such as overall benefits paid to former employees and whether contributions are paid timely. In 2020 these deductions are capped at the annual maximum of 19672. I certify to the best of my knowledge the foregoing statements are complete and true.

This is 9675 more than the maximum weekly benefit for 2021. Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged. 2021 Paid Family Leave Rate Increase.

Use the calculator below to view an estimate of your deduction. Paid Family Leave PFL is now available to eligible employees of the City of New York. Employee-paid premiums should be deducted post-tax not pre-tax.

NEW YORK PAID FAMILY LEAVE 2020 vs. Paid family medical leave. 2019 Rate and Maximum Contribution.

Paid Family Leave PFL Employee Fact Sheet PSB 440-16 Paid Family Leave for Represented Employees The deduction rate for 2022 is 0511 of an employees gross wages each pay period with a maximum annual contribution of 42371. An employers experience rate will not necessarily increase. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0270 of your gross wages each pay period.

For 2022 the SAWW is 159457 which means the maximum weekly benefit is 106836. For 2019 the maximum contribution rate for Paid Family Leave will go from 0126 to 0153 of the employees gross annualized wages capped at the new. A leave can be taken during the first 12-months after a childs birth to bond or during the first 12-months after adopting a child or becoming a foster.

1887 to inform agencies of the 2021 rate for the New York State Paid Family Leave Program. Deductions for the period of time I was covered by this waiver and this period of time counts towards my eligibility for paid family leave. The Paid Family Leave wage replacement benefit is increasing.

NEW YORK PAID FAMILY LEAVE 2018 vs. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service.

Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages. Employers may collect the cost of Paid Family Leave through payroll deductions. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation. You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits. Duration maximum 12 weeks.

The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. Paid Family Leave may also be available.

Pregnancy And Maternity Paternity Leave In Ny State The Law Offices

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

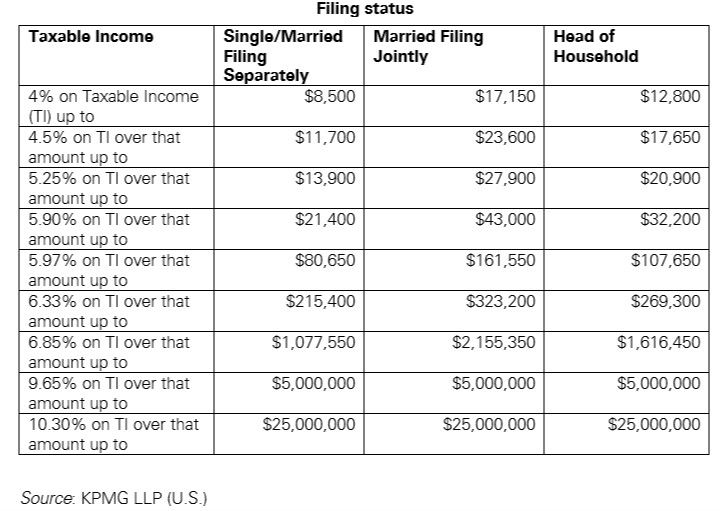

Us New York Implements New Tax Rates Kpmg Global

Cost And Deductions Paid Family Leave

New York Paid Family Leave Updates For 2022 Paid Family Leave

New York State Paid Family Leave Law Guardian

2021 Instructions For Schedule H 2021 Internal Revenue Service

Get Ready For New York Paid Family Leave In 2021 Sequoia

New York State Paid Family Leave Cornell University Division Of Human Resources

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Closing Cost Estimator For Seller In Nyc Hauseit New York City

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Get Ready For State Paid Family And Medical Leave In 2022 Sequoia